The FTC has been investigating FES/UWE for over a year. In support of its Motion for a Receiver, it has collected over a dozen witness statements of former FES/UWE agents, many of whom claim they were lied to by other FES/UWE agents about what they could accomplish with credit repair.

Legit Credit Repair vs Illegit Credit Repair

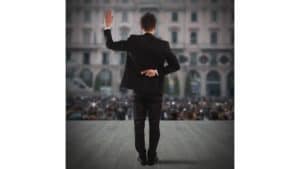

Many credit repair companies unfortunately, are not legitimate and make a lot of deceptive promises to get your money. The FTC has collected affidavits from many former FES Agents who swear that they were deceived by other FES Agents with these lies:

- We can get your credit score up by over 100 points in 3 months or less;

- We can remove everything that is negative on your credit report;

- Do not pay the judgment against you, we can remove that too;

- We can get the bankruptcy removed from your credit report;

- If the credit reporting agencies do not respond to our dispute letters, they can be held legally accountable and must remove the negative items.

- Our dispute letters are 100% effective at removing negative items.

None of these statements is true. If anyone makes any of these statements to you, run away from them as fast as you can as they are lying to you. Here are the truths about credit repair:

- No one can predict a credit score increase or decrease. Credit scores are fluid things. While 35% of your credit score is made up of timely made payments, and 25% is dependent on how much credit you use, these things can change daily. We once had a client for whom we were able to remove negative incorrectly reporting information and her credit score still went down. Why? She used a greater portion of her available credit. This is called utilization. Her utilization shot up from 50% to 90% during the time we were litigating her case. If nothing else changed, her credit score would probably have gone up, but we have no way of knowing how much or when it would have gone up.

- Chances are infintismal that everything negative on your credit report is inaccurate. The only time we have seen this happen is when someone, who usually has excellent credit, has had their identity stolen. When credit bureaus receive letters disputing all negative items on a credit report, they know that these letters are bogus.

- Judgments do not appear on your credit reports. Back in 2018, the credit bureaus stopped reporting judgments. They were mixing judgments up with the people against whom they were directed. If there were 2 Bill Smiths in a single town, the credit bureaus would often place that judgment on their credit reports even though only one of them was the right defendant. Even if you have a judgment against you, there is nothing a credit repair company can do to remove it. To get a judgment removed against you, you need a lawyer to file a Motion to Set Aside the judgment. Even then, its an uphill fight.

- Bankruptcies cannot be removed from a credit report unless they are not legit. This is a very rare circumstance. Many times, people erroneously think that because they did not complete a bankruptcy or after they filed, it was dismissed, that it should not be reporting on their credit reports. This is simply not true. Once someone files for bankruptcy, that filing is a matter of public record and stays on your credit report. Chapter 13s stay on your credit report for up to 7 years and Chapter 7s stay on for up to 10 years. No credit repair company can do anything about it unless the bankruptcy does not belong to you.

- The credit bureaus are legally required to respond to consumer disputes within 30 days but often fail to do so. Legally speaking, if they cannot confirm the accuracy of an item on your credit report that you dispute, they must remove it until they can verify it. However, if they fail to remove it after 30 days, unless you can prove that it is inaccurate, you do not have grounds to sue them credit reporting agencies.

- There is no magic to writing a dispute letter. Every so often, you come across a snake oil salesman who professes to have a super secret dispute letter that will remove all negative items off of your credit reports. Its just a lie. A good dispute letter identifies yourself clearly, the tradeline that you are disputing and a valid reason for the dispute. That’s it. There is nothing more to a good dispute letter than that.

Call us to today to start your free credit repair journey with us.

Now that you know the difference between legit and illegitimate credit repair, you should sign up with us today. We will dispute items on your credit report that do not belong on it because they are not legitimate or not verifiable. It’s the only way to do credit repair in a legally compliant manner. We do not charge any fees to you for sending out dispute letters. We only make money when we file lawsuits to enforce your rights. Even then, we only look to the defendants to pay our fees and costs so nothing comes out of your pocket. At Credit Repair Lawyers of Florida, we are credit repair lawyers; we are NOT a credit repair company. Call us today at (877) 293-2882 or email us at [email protected] for more information.